Atidot’s platform versatility gives

answers to any use case:

-

Understanding Policyholders

30% of customers need a high level of personalized advice. With Atidot, you can better understand individual policyholders to make sure they are properly insured.

-

Predicting Customer Needs

Atidot allows you to predict policyholders’ financial needs so you can identify upsell and cross-sell opportunities, and offer customers the right product at the right time and price.

-

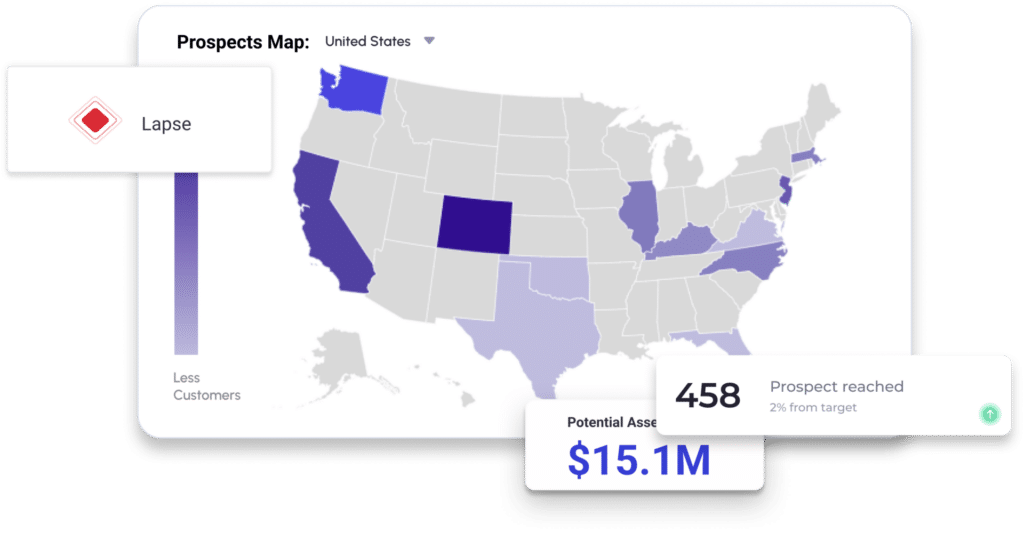

Knowing Who

Will Lapse30% of policyholders aren’t actively receiving services, which is the main reason for lapsation. Atidot tells you who will lapse, where and why so you can retain more policyholders and start saving resources immediately.

-

Implementing a

Retention PlanIf you don't have a retention plan, Atidot can implement a customized outreach program to prevent lapsation, keeping more policies and valuable customers on your books.

-

Finding the Profit

Assigned policies are 2X more profitable than their non-assigned counterparts. Atidot provides an end-to-end solution to increase customer satisfaction and potentially increase the face value of their policies.

-

Reaching the Right Customers

We’ll let you know which customers need better service, and how best to reach them. To save you valuable time, Atidot also offers a comprehensive solution where we implement this service on your behalf.

-

Going Beyond

InsightsAtidot goes far beyond running modules on your in-force data to produce insights. Our insights are streamlined into marketing actions and policyholder outreach, yielding new revenues at very low risk.

-

Having an End-to-End Solution

Atidot provides a complete end-to-end solution, including a bespoke CRM solution that captures all data and seamlessly connects with your legacy systems.

-

Product Dashboards

Use Atidot’s sophisticated, real-time product dashboards to understand why products are succeeding or underperforming based on parameters like geography, age groups, health conditions and more.

-

Distribution Dashboards

Renegotiate or improve your distribution agreements based on what your direct competitors are doing. Predict broker trends and understand your channels’ strengths and weaknesses to make sure you stay ahead of the curve.

-

Optimize

Your ProcessGain a deep understanding of your underwriting process and optimize your placement ratio.

-

Stay Ahead of

your CompetitionAtidot’s customized insights will show you exactly where you are improving and where you are losing customers to your competition.

-

On Point

EstimationsIf you are a TPA or a BPO, accurately estimate the potential within your book of business for any purpose, with Atidot’s predictive analytics.

-

Efficient, Real-Time Assessments

Gain a deep understanding of the embedded risks as well as upsell and cross sell potential by running advanced analytics that are fast to implement and scalable.

-

Improved profitability

and credibilityImprove profitability and efficiency by providing your agents and brokers with real-time recommendations for their customers

at the point of sale. -

Real-Time

RecommendationsSee who is underinsured compared to their peers, which policies are at risk of lapsation and what their Lifetime Value (LTV) is projected to be before they place the policy.